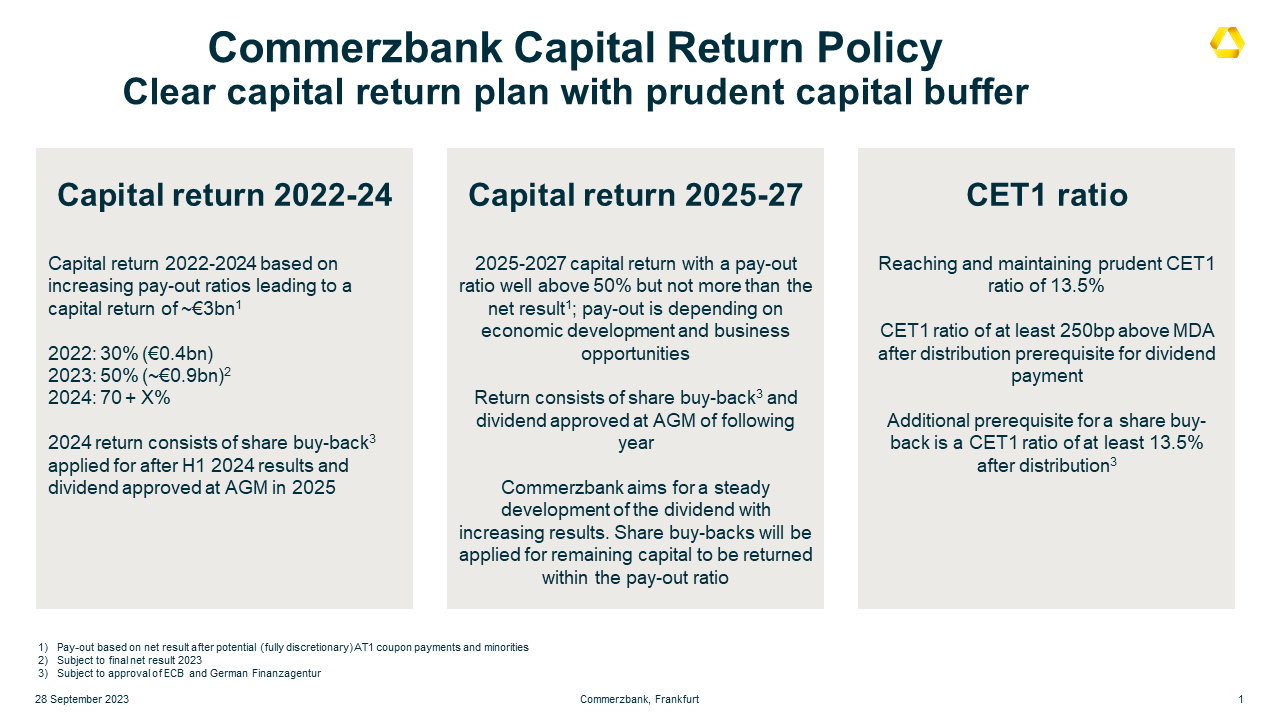

- For the years 2022 to 2024 Commerzbank intends to return €3bn to shareholders as dividends and share buybacks. To reach this target, the pay-out ratio will be at least 70% for 2024.

- For the years 2025 to 2027 Commerzbank intends to regularly return capital to shareholders with a pay-out ratio well above 50% but not more than the IFRS net profit*. The pay-out is dependent on the economic development and business opportunities. Commerzbank aims for a steady development of the dividend with increasing results. Share buybacks will be applied for remaining capital to be returned within the pay-out ratio.

- Prerequisite for a dividend is a CET1 ratio of at least MDA + 250bp after distribution. Additional prerequisite for a share buyback is a CET1 ratio of at least 13.5% after distribution.

- The capital return policy reflects the current targets of the management board and the supervisory board and may be amended in future.

- A prerequisite for a dividend payment or buyback is a corresponding proposal by the managing board and the supervisory board.

- A dividend needs the approval of the shareholders at the Annual General Meeting (AGM). Commerzbank intends to ask the AGM each year for pre-approval of the legally allowed maximum buyback volume of 10% of outstanding shares. Furthermore, share buybacks are subject to approval by the ECB and the German Finanzagentur.

* after deduction of AT1 coupon payments and minority interests